Wise.com: Revolutionizing Global Money Transfers and Financial Services

In today’s interconnected world, international money transfers are more important than ever. Wise.com, formerly known as TransferWise, has emerged as a game-changer in this domain, providing a transparent, cost-effective, and easy-to-use platform for sending money across borders. In this article, we will explore all the services offered by Wise, its unique advantages, and how it stands out from traditional financial services.

What is Wise.com?

Wise is an online financial technology company founded in 2011 by Taavet Hinrikus and Kristo Käärmann. Initially launched as a solution to the high fees and poor exchange rates offered by banks, Wise has since expanded its services, becoming a fully-fledged financial services provider. The company now offers international money transfers, multi-currency accounts, business accounts, debit cards, and more. With a mission to make money borderless, Wise is trusted by over 10 million users globally.

Core Services Provided by Wise.com

1. International Money Transfers

One of Wise’s flagship services is its international money transfer platform. Unlike traditional banks, Wise uses real exchange rates, often referred to as the mid-market rate. This means that users get the best possible rate without hidden markups. Wise charges a small, transparent fee that varies depending on the currency and destination, but it is typically much lower than the fees charged by banks.

Key Features:

- Real-time exchange rates: No inflated exchange rates or hidden costs.

- Fast transfers: Depending on the currency and method, many transfers are completed within minutes.

- Low fees: Up to 8x cheaper than most banks.

- Global coverage: Supports over 70 countries and 50 currencies.

2. Wise Multi-Currency Account

Wise offers a multi-currency account that allows users to hold, send, and receive money in different currencies. This is particularly beneficial for freelancers, expatriates, and frequent travelers who need to manage funds across various countries.

Key Features:

- Over 50 currencies supported: Hold and manage money in multiple currencies.

- International bank details: Get local bank account details in different regions like the UK, Europe, Australia, and the US.

- Instant conversion: Convert between currencies using real-time exchange rates.

- Free to set up: No monthly fees to maintain the account.

3. Wise Business Accounts

For businesses operating internationally, Wise offers a specialized business account that simplifies sending and receiving payments across borders. It is designed to help small to medium-sized businesses (SMBs) reduce the cost of international transactions and streamline their financial operations.

Key Features:

- Batch payments: Send payments to up to 1,000 people at once.

- Integration with accounting tools: Sync with software like Xero and QuickBooks.

- Multi-currency invoices: Issue invoices in various currencies.

- Low fees for international payments: Significantly cheaper than traditional banks.

4. Wise Debit Card – Join here and GET A FREE CARD ( Normal price €7 )

Wise offers a debit card that can be used to spend in multiple currencies without any hidden fees. It is ideal for travelers, digital nomads, and anyone who frequently makes purchases in different countries.

Key Features:

- No foreign transaction fees: Spend in over 200 countries without extra charges.

- Real-time currency conversion: Automatically converts currencies at the best exchange rate.

- ATM withdrawals: Free withdrawals up to a certain limit.

- Track spending: Easily track your spending through the app.

5. Borderless Account for Freelancers

Freelancers working with international clients often face the challenge of getting paid in different currencies. Wise’s Borderless Account solves this by allowing users to receive payments in local currencies without high conversion fees.

Key Features:

- Receive like a local: Get paid as if you had local bank accounts in key regions.

- Low conversion fees: Transfer money into your local currency at competitive rates.

- Invoice in multiple currencies: Send invoices and get paid in the currency that suits your clients.

Why Choose Wise Over Traditional Banks?

1. Cost Transparency

One of Wise’s most significant advantages is its cost transparency. Traditional banks often add hidden fees through inflated exchange rates, while Wise shows users the exact fee upfront. The total cost is clear before the transaction is made, making Wise a more honest option.

2. Speed of Transfers

With many transfers being processed instantly or within hours, Wise offers faster services than traditional banks, where international transfers can sometimes take days.

3. Security and Trustworthiness

Wise is regulated by financial authorities in multiple countries, ensuring that the platform meets rigorous security standards. The company employs top-level encryption and security measures to safeguard user data and funds.

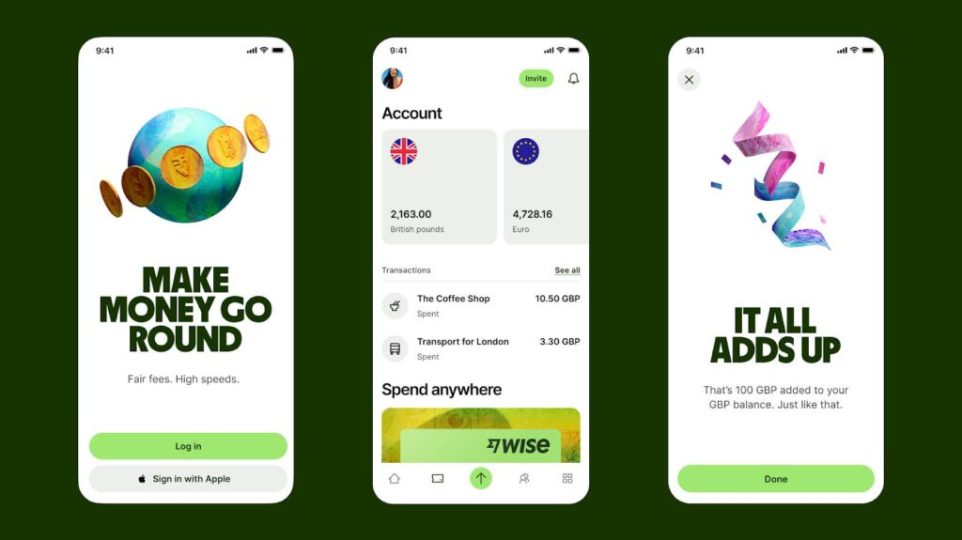

4. Easy to Use

Whether you are transferring money through the mobile app or desktop platform, Wise offers a user-friendly experience. The process of transferring money is straightforward and typically takes only a few minutes.

How to Use Wise.com: A Step-by-Step Guide

Step 1: Sign Up for an Account

The first step is to create an account on Wise.com. You can do this either by using your email address or linking your Google or Facebook account.

Step 2: Set Up a Transfer

Once your account is ready, you can initiate a money transfer by selecting the amount, currency, and destination. Wise will provide a detailed breakdown of the fees and exchange rate before you confirm the transfer.

Step 3: Pay for Your Transfer

You can pay for your transfer via bank account, credit card, debit card, or other methods depending on your location. Wise offers various payment options to make the process as convenient as possible.

Step 4: Track Your Transfer

After payment, you can track your transfer in real time. Wise will notify you when the transfer is complete, and you can also track its progress via the app or website.